How does it work?

1

Allocate funds

To get started, simply allocate your preferred crypto into YieldVault.

2

Receive rewards

Rewards are generated by "minting" DUSD using negative interest rates. These rewards are either directly distributed back to you in DUSD or swaped for other crypto tokens.

3

Sit back and relax

Bake manages this entire process, so you don’t have to do anything extra after you’ve allocated your funds.

Questions? Answers

What are the supported cryptocurrencies?

The popular cryptocurrencies are supported with our YieldVault service. You may allocate Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), Tether (USDT), EURO Coin (EUROC), DeFiChain (DFI) and Decentralized USD (DUSD) tokens.

How are the rewards generated through the DeFiChain vaults?

Rewards through DeFiChain vaults are generated by depositing collateral, which allows for the minting of DUSD through negative interest rates. If you choose to receive rewards in the native token you deposited, the minted DUSD is swapped into that coin (e.g. DUSD to BTC or ETH) before being distributed to you. However, if you choose to receive rewards in DUSD, there is no swap and a higher APY. Your deposited collateral is not used for lending or liquidity mining, so there are no counterparty or impermanent loss risks for you

How can I trust that my crypto assets are safe with YieldVault?

We understand the importance of keeping your crypto assets safe, which is why we provide full transparency on how we manage your funds. With YieldVault, you can track all transactions, rewards and other on-chain data on our Transparency page. We believe in trust through verification, which is why we make it easy for you to see exactly what's happening with your assets.

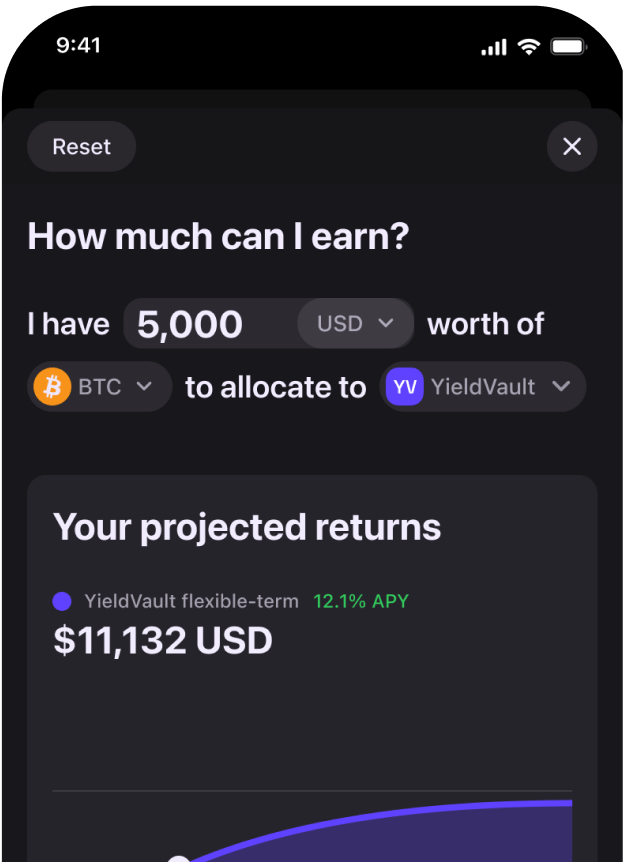

What fees are associated with YieldVault?

The APY and returns you see displayed are net of all fees. After allocating your funds into YieldVault, there are no hidden or additional fees. Bake takes a 15% commission on all rewards for YieldVault.

Can I withdraw my funds from YieldVault at any preferred time?

Yes, you can. There’s no lockup period.

Learn more

What are the risks of using YieldVault?

While YieldVault does not involve impermanent loss or counterparty risks, there are still some potential risks to be aware of. These include smart contract, protocol, and liquidation risks. Before investing in any cryptocurrency, it's important to do your own research (DYOR) to understand the potential risks associated with DeFi investments.

It's also important to note that YieldVault may be updated or changed in the future, depending on the status of negative interest rates from DUSD loans. This could result in a gradual reduction of yields or a shift to a different yield-generating mechanism. While we do not expect any changes in the near future, users should stay informed and exercise caution.

Get the app

Discover new ways to build and grow your digital assets portfolio. Over 1 million people trust Bake.